U.S. Leading Indicators, Retail Sales, And Atlanta Fed Forecast Signal Strength

Published Friday, April 19, 2019 at: 7:00 AM EDT

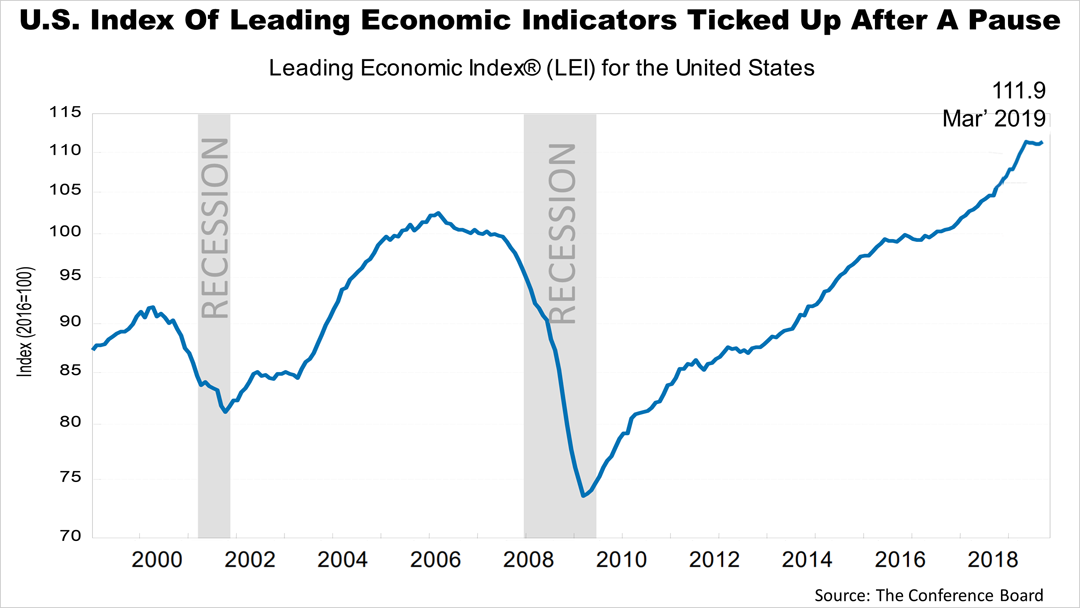

The Leading Economic Index (LEI) for the U.S. increased by four-tenths of 1% in March, following a one-tenth of 1% increase in February, and showing no change in January.

"The US LEI picked up in March with labor markets, consumers' outlook, and financial conditions making the largest contributions," said Ataman Ozyildirim, Director of Economic Research at The Conference Board, which administers the LEI. "Despite the relatively large gain in March, the trend in the US LEI continues to moderate, suggesting that growth in the US economy is likely to decelerate toward its long term potential of about 2% by year end."

This chart shows how the LEI definitively rolled over months in advance of the last two recessions, illustrating why the LEI is recognized as a reliable forward-looking indicator of a recession. As the LEI stands near a record high not reached in the two previous expansions and shows no sign of recession, the economy is growing slower than the 2018 growth spurt.

© 2024 Advisor Products Inc. All Rights Reserved.