Stocks Have Soared Lately, But What Should You Expect Near And Long-Term?

Published Friday, August 12, 2022 at: 7:49 PM EDT

Securities regulators require financial advisors to state in their public statements that past performance is not indicative of future results because investing is complicated, and nothing is guaranteed. Ironically, however, a mountain of evidence exists showing that achieving investment success depends largely on understanding lessons from the past.

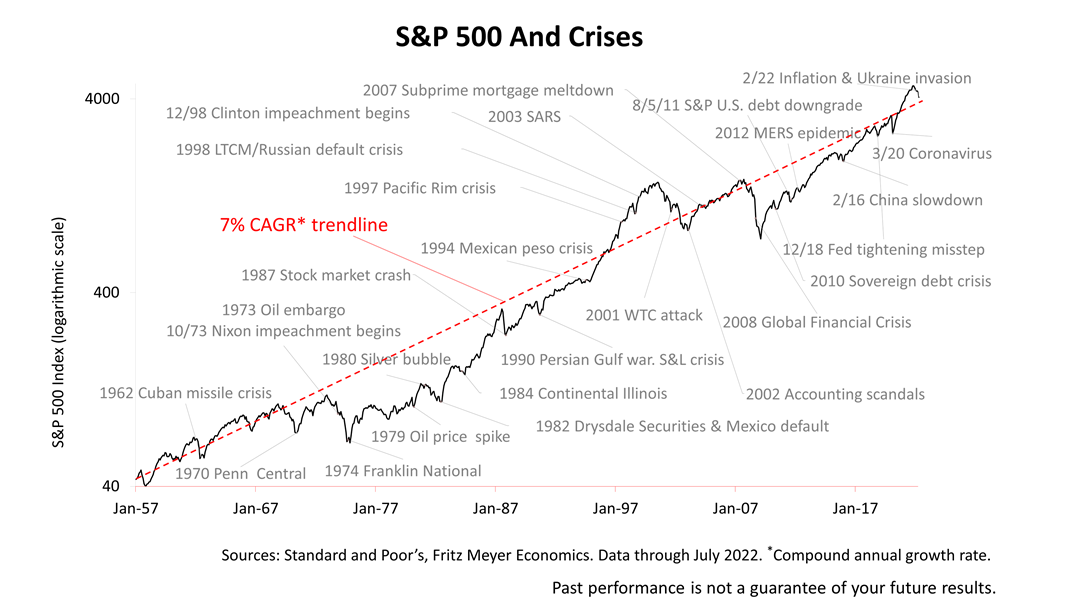

Since the post-war era began in 1957, at least 27 financial crises have come and gone. Perhaps the worst crisis of the past 65 years was the near-collapse of the world financial system in 2008. It was resolved by unprecedented government intervention. Poignantly, every unprecedented crisis was resolved, often by unprecedented U.S. Government solutions and other unimagined events. Despite all of the tumult in the world, the Standard & Poor’s 500 compounded annually at a growth rate of about 7% in the 65 years ended July 31, 2022.

©2022 Advisor Products Inc. All Rights Reserved.